If you’re starting a new business—especially if you’re still pre-revenue—you’ve probably heard investors, advisors, or accelerators say:

“You need a financial model.”

But what exactly is a startup financial model, and why is it so important?

Whether you’re planning your first round of funding or just trying to understand how your idea will make money, a financial model isn’t just a spreadsheet—it’s a roadmap for your business.

The Startup Virtue Financial Model is designed specifically for early-stage founders. It helps you build professional, investor-ready projections—even if you’ve never built a model before.

What Is a Startup Financial Model?

At its core, a financial model is a structured tool—usually built in Excel or Google Sheets—that projects your startup’s financial performance over time.

It translates your business plan into numbers, showing how your strategy, operations, and assumptions come together to drive revenue, expenses, and profitability.

A good startup financial model typically includes:

Revenue projections (your sales forecast)

Operating expenses (like salaries, marketing, and software tools)

Capital expenditures (equipment, development costs, etc.)

Pro forma financial statements (income statement, balance sheet, and cash flow)

These pieces work together to tell a complete financial story of how your startup will grow—and when it might become profitable or need more funding.

Why Every Startup Needs a Financial Model

Even if your startup is pre-revenue (or just an idea on paper), building a financial model offers major benefits. Here are some of the biggest reasons founders need one:

1. It Helps You Understand Your Business

A model forces you to think through the key details:

How will you acquire customers?

What will they pay?

What are your biggest costs?

How much funding do you need to get to your next milestone?

These aren’t just numbers—they’re strategic decisions. Modeling them helps you test scenarios, see how assumptions impact results, and make smarter choices early on.

2. It Shows Investors You Have a Plan

When you pitch to investors, they don’t expect you to predict the future perfectly. What they do expect is that you’ve thought through how your business will grow and how their capital will be used.

A solid, bottom-up financial model demonstrates that you understand your unit economics, your go-to-market strategy, and your path to profitability. It gives investors confidence that you know what levers to pull to make your startup succeed.

3. It Helps You Manage Cash (and Avoid Surprises)

Cash flow is one of the biggest reasons startups fail. A good financial model helps you forecast when money comes in, when it goes out, and how much runway you have left.

This clarity helps you make timely decisions—like when to raise more funding, adjust expenses, or slow down hiring.

4. It Keeps Your Team Aligned

A financial model isn’t just for investors—it’s also for you and your team. It turns goals into measurable targets. When everyone can see how growth, expenses, and milestones fit together, it creates alignment and accountability.

What a Good Startup Financial Model Looks Like

The best startup financial models are:

Simple to use, but detailed enough to be meaningful

Flexible, so you can update assumptions easily

Transparent, with clear logic and labeled inputs

Comprehensive, covering revenue, costs, and cash flow

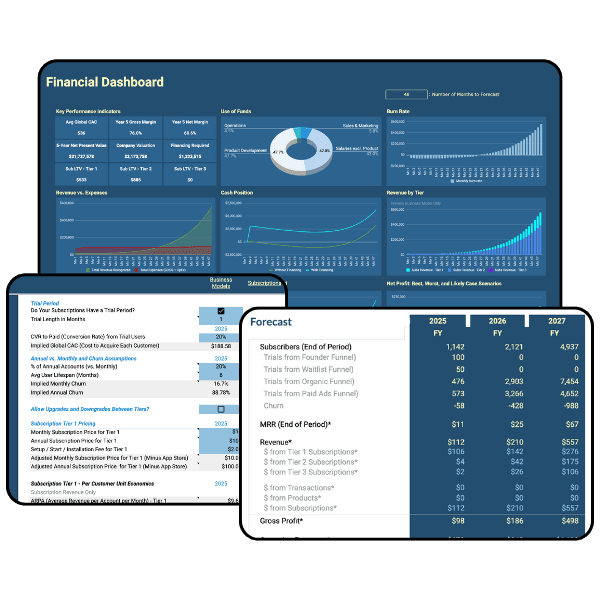

The Startup Virtue Financial Model is built with these principles in mind. It’s designed for founders who may not have a finance background but still want professional, investor-grade forecasts.

It includes:

Structured inputs for both top-down and bottom-up sales forecasting

Automatic generation of pro forma financial statements

Scenario analysis tools (base case, best case, worst case)

Clear visuals and summaries for easy investor review

When to Build Your Startup’s Financial Model

You don’t need to wait until you’re raising capital to build your financial model. In fact, the earlier you start, the better.

Founders use financial models to:

Validate their business idea

Estimate funding requirements

Plan hiring and growth

Prepare for accelerator applications

Communicate strategy to investors and co-founders

Even if you only have a few assumptions to start with, modeling them now helps you stay focused and make data-driven decisions as your startup grows.

Final Thoughts

A startup financial model isn’t about predicting the future—it’s about preparing for it.

By building one, you gain clarity, control, and confidence in your business plan. And when you’re ready to raise money, your investors will see that you understand both the opportunity and the execution.

The Startup Virtue Financial Model makes it simple to get started. Whether you’re pre-revenue or scaling fast, it helps you build credible forecasts, professional pro forma statements, and investor-ready insights—all in one easy-to-use file.