Founders often ask a simple question:

“Are we ready to raise?”

Investors answer a different question:

“Is this company fundable right now?”

Those two questions sound similar—but they’re not the same. This page explains how investors think about fundability, what actually goes into that judgment, and what your Fundability Score is designed to measure.

Fundability Is About Timing, Not Just Quality

A company can be good and still be unfundable at the moment.

Investors don’t just evaluate whether an idea is interesting. They evaluate whether:

The story is clear enough to underwrite

The risks are identifiable (and acceptable)

The next phase of the business is well-defined

Fundability is ultimately a question of timing:

Is this company at a stage where outside capital can be deployed productively, with a reasonable chance of return?

That timing depends on far more than the idea itself.

How Investors Actually Assess Fundability

While every investor has their own style, most early-stage funding decisions revolve around five core areas.

1. Problem & Market Clarity

Investors want to know:

Is the problem specific and real?

Who exactly experiences it?

Is the market large enough to matter if this works?

Vague problems and overly broad target customers make it hard to build conviction. Clear framing makes everything else easier.

2. Traction & Validation

Traction doesn’t have to mean massive revenue—but it does need to reduce uncertainty.

Depending on stage, that might include:

Customer conversations and feedback

Active users or pilots

Early revenue

Retention or repeat usage

Investors are asking:

What evidence do we have that this isn’t just a theory?

3. Business Model & Unit Economics

At early stages, investors don’t expect perfection—but they do expect coherence.

They want to understand:

How the company makes (or will make) money

What drives costs

Whether the model can scale

A fundable company can explain its economics clearly, even if they’re still evolving.

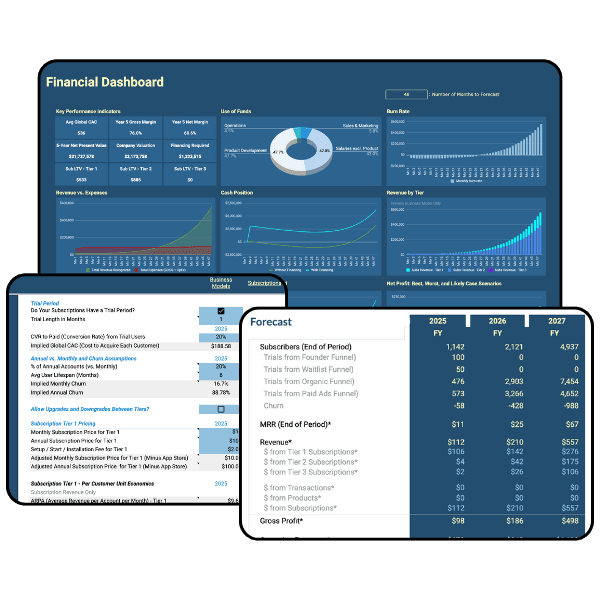

4. Financial Readiness

This is where many fundraising efforts quietly fall apart.

Investors look for:

A clear financial model

Defensible assumptions

An understanding of burn and runway

A credible use of funds

The financials don’t need to be right. They need to be thoughtful, internally consistent, and tied to reality.

5. Founder & Execution Readiness

Finally, investors evaluate the people behind the company:

Is the team committed?

Do they understand the risks?

Can they articulate priorities and tradeoffs?

Fundability increases when founders demonstrate focus, self-awareness, and the ability to execute the next phase—not just the vision.

What the Fundability Score Measures

The Fundability Score is designed to approximate how an early-stage investor might view your company today, not in some ideal future state.

It measures:

Clarity, not charisma

Readiness, not ambition

Evidence, not optimism

The assessment evaluates your company across the five areas above and produces:

An overall Fundability Score

A breakdown by category

Insight into where your biggest gaps (and strengths) likely are

This score is not a verdict. It’s a diagnostic.

How to Interpret Your Score

Lower scores typically indicate that fundraising now would be inefficient or distracting, and that focusing on validation or clarity would likely create more value.

Middle-range scores suggest you may be fundable to the right investors, but that positioning, narrative, or financial readiness will matter a lot.

Higher scores indicate that fundraising is primarily an execution challenge rather than a readiness problem.

Importantly, improving fundability is often less about doing more—and more about doing the right next things.

Why This Matters Before You Raise

Fundraising is time-consuming, emotionally taxing, and expensive in opportunity cost.

Understanding your fundability before you start allows you to:

Choose the right type of capital

Set realistic expectations

Avoid premature or inefficient raises

Tell a clearer, more credible story to investors

Whether you raise now or later, clarity compounds.

What to Do Next

If you’ve completed the assessment, use your results as a starting point:

Focus first on your weakest areas

Pressure-test your assumptions

Align your financial narrative with your actual stage

Fundability isn’t about checking boxes. It’s about making your company easier to believe in—at the right time.