Let’s get one thing straight: the earlier your startup is, the less anyone can reasonably forecast your financial future. If you’re pre-revenue—or even pre-product—your numbers are inherently speculative. Key assumptions, customer adoption rates, pricing, and growth all exist in the realm of guesswork.

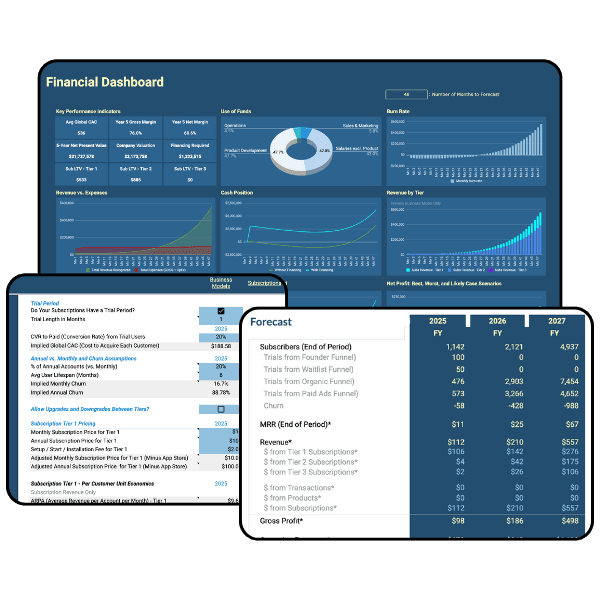

And yet, investors will ask for a financial model. They won’t invest in the numbers themselves—the forecasts will almost certainly be wrong—but they will invest in the thinking behind them. How you arrived at those assumptions, how you organize your logic, and how deeply you understand your business tells investors more than the numbers ever could.

Here’s what investors are really looking for—and what they see as red flags—when reviewing a startup financial forecast.

1. Logic and Organization: The Model as a Window Into Your Thinking

A well-organized, easy-to-understand financial model is more than a spreadsheet—it’s proof of how you approach your business day-in and day-out.

Investors look for models that are:

Clearly structured

Transparent about assumptions

Comprehensive enough to show you understand the key levers of growth

If your model is sloppy, confusing, or full of hidden assumptions, it sends the message that you may approach your business the same way—and investors will take notice.

2. Focus on Key Drivers: What Actually Moves the Needle

Not every number is equally important. Investors want to see that you understand your key drivers—the variables that truly impact revenue, costs, and growth.

This might include things like:

Customer acquisition and conversion rates

Pricing and margins

Retention or churn rates

Spending too much time on minor details or factors that barely affect the outcome shows a lack of focus and can undermine investor confidence.

3. Ratios and Scaling: Do the Numbers Make Sense Together?

Investors check that revenues and costs scale proportionally. If your revenue triples while expenses stay the same without explanation, that’s a red flag.

Ratios, margins, and unit economics should make sense. They don’t have to be perfect, but they must demonstrate a rational, scalable business model.

4. Feasibility: Realistic, Not Overly Optimistic

Founders tend to be optimistic—and investors expect that—but overly optimistic projections can destroy credibility.

Numbers should be compelling, but also achievable. Investors are less concerned with hitting exact targets than they are with your logic and assumptions. They want to see that you’ve thought carefully about what’s possible, what’s risky, and what can go wrong.

5. Founder Experience and Team

At the end of the day, investors invest in founders, not spreadsheets.

They want to know:

Do you have the right experience to execute this plan?

Have you built or hired a capable team?

Can this team navigate the challenges of your industry?

A strong founding team with complementary skills can turn even speculative numbers into credible projections.

6. Founder Salaries: Take What You Need to Focus

Investors want to see that founders are planning to pay themselves a reasonable salary. A zero-dollar salary can suggest you won’t be financially supported enough to focus on growing the business.

But a salary that’s too high can signal misplaced priorities or a lack of humility. The sweet spot is a modest, sustainable salary that allows you to focus on the business full-time while signaling to investors that you are disciplined.

7. Market, Industry, and Competitor Knowledge

A credible financial forecast reflects deep knowledge of your market. Investors expect you to know:

The size of your market and its growth potential

Industry trends and dynamics

Competitors and differentiation

If your assumptions ignore market realities—or competitors—investors will spot it immediately.

8. Traction: Even a Little Counts

Even if your startup is pre-revenue, investors want to see some form of traction. This could include:

Early adopters or letters of intent

Beta users or product pilots

Partnerships or strategic relationships

Social proof or community engagement

Traction signals that your assumptions are grounded in reality—and that your startup has potential to execute on the forecasted growth.

Bottom Line: Investors Care About Your Thinking, Not Your Numbers

If you’re building a financial forecast for a pre-revenue startup, remember this:

Investors don’t invest in numbers—they invest in the logic, judgment, and understanding behind the numbers.

A strong forecast demonstrates that you:

Understand the levers of your business

Know what assumptions matter most

Can rationally and realistically plan for growth

Have a capable team and the right experience to succeed

Conversely, red flags like overly optimistic numbers, unclear assumptions, or sloppy models can hurt credibility before your startup even launches.

In the end, a well-thought-out financial model is less about precision and more about persuasion. It shows investors that you’re ready to tackle the hard work of building a business, even if the numbers themselves will inevitably change.