When you’re building a financial model for your startup, one of the most important (and intimidating) steps is forecasting sales and revenue.

Whether you’re building your first pro forma financial statements or preparing for investor meetings, your forecast tells the story of how your business will grow. And for investors, that story needs to make sense—not just in ambition, but in execution.

That’s where understanding top-down vs. bottom-up sales forecasting becomes essential.

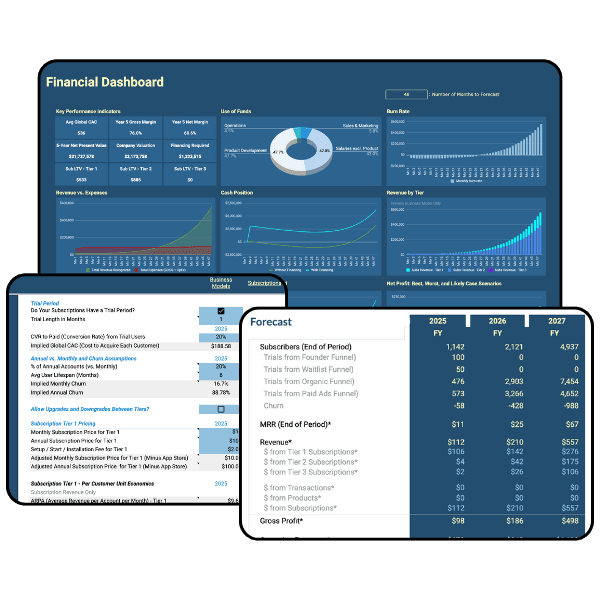

The Startup Virtue Financial Model includes built-in tools for both forecasting methods. It lets you compare results side by side and analyze how each approach affects your overall revenue projections—so you can create a clear, credible, investor-ready financial model.

What Is a Top-Down Sales Forecast?

A top-down forecast starts with the big picture—the total size of your market—and works down to estimate your company’s share of that market.

For example:

“The global pet food market is $100 billion. If we capture just 0.5% of that, we’ll generate $500 million in revenue.”

This method is useful for showing the scale of the opportunity and demonstrating that you’re operating in a large, growing market. It’s fast, high-level, and helps investors understand the potential upside.

But there’s a catch: top-down forecasts can easily feel too optimistic—especially for early-stage, pre-revenue startups. Saying you’ll win a fraction of a billion-dollar market doesn’t explain how you’ll get there.

That’s where bottom-up forecasting comes in.

What Is a Bottom-Up Sales Forecast?

A bottom-up forecast builds from the ground up. Instead of starting with market size, it starts with your actual business drivers—the activities, costs, and conversion rates that generate revenue.

For example, you might project:

How many leads or customers you expect to acquire per month,

Your customer acquisition cost (CAC) and marketing spend,

Your pricing model or average revenue per user (ARPU), and

How retention, churn, or repeat purchases affect future sales.

From these detailed assumptions, your financial model projects monthly growth, showing how your operations translate into real revenue over time.

The result is a data-driven, execution-focused forecast that investors find far more credible.

Why Bottom-Up Forecasting Matters More to Investors

When you’re pitching to investors, the most compelling financial models aren’t the ones with the biggest numbers—they’re the ones that show how you’ll achieve them.

A bottom-up forecast demonstrates that you’ve thought through:

How you’ll reach customers,

What resources you’ll need (team, marketing, capital),

What your conversion rates and costs look like, and

How your growth will scale sustainably.

Top-down forecasting helps you illustrate market potential.

Bottom-up forecasting helps you prove your execution plan.

That’s why investors tend to trust bottom-up forecasts more—they reflect a founder’s understanding of their go-to-market strategy, unit economics, and revenue engine.

The Power of Combining Both Methods

In reality, the best startup financial models use both approaches together.

Your top-down forecast sets the ceiling: the total addressable market and long-term potential.

Your bottom-up forecast maps the floor: the realistic, operational path to get there.

The Startup Virtue Financial Model brings both perspectives together. It includes:

Structured worksheets for both top-down and bottom-up projections,

Automated comparisons to highlight gaps and assumptions, and

Investor-ready pro forma financial statements (income statement, balance sheet, and cash flow).

By analyzing both forecasts side by side, you can identify whether your growth assumptions are reasonable and ensure your model tells a consistent, credible story.

Final Thoughts: Building a Credible Financial Model as a Pre-Revenue Startup

If you’re pre-revenue, you don’t need to have perfect data to build an investor-ready financial model. What matters most is that your assumptions are logical, transparent, and clearly tied to your business plan.

A bottom-up sales forecast gives investors confidence that you understand your growth levers.

A top-down forecast shows them the size of the prize.

Together, they create a balanced, believable financial narrative.

Our Startup Financial Model Template is built specifically for early-stage entrepreneurs. It helps you:

Build accurate sales and revenue forecasts,

Generate professional pro forma financial statements, and

Compare top-down and bottom-up projections seamlessly