You’ve got a great idea. You’re convinced it’s the next big thing. But here’s the truth: ideas are cheap, even if they have the potential to evolve into a billion-dollar business.

The startup world is full of myths about fundraising—stories of founders who raise millions overnight or land investors after a single coffee meeting. The reality? Raising startup capital is almost always a grind that requires strategy, patience, and persistence.

If you’re an early-stage founder preparing to raise capital, here are six common fundraising myths—and the truths (and tactics) you need to know to make your raise more successful.

Myth #1: All You Need Is a Great Idea

Reality: Great ideas are everywhere. Execution, persistence, and process are what get funded.

Jeff Bezos pitched Amazon to 60 investors. 40 said no. That’s a 67% rejection rate for what became a $1.7 trillion company. Those rejections weren’t quick “no’s” either—Bezos described them as “hard-earned no's,” the result of multiple meetings and relentless follow-ups just to chase a $50,000 check.

The stories you read about founders raising millions in a week? Those are rare exceptions, typically from serial entrepreneurs with deep networks and prior exits. For everyone else, raising capital requires structure and grit.

Advice:

Implement a fundraising process. Use a CRM or even a simple spreadsheet to track every investor interaction—from outreach to follow-ups to term sheet negotiations. Treat fundraising like a full-time job that may take 3 to 6 months. Expect rejection, stay organized, and keep refining your pitch.

Myth #2: You Should Accept Any Money You Can Get

Reality: Your investor relationship is just as important as the money it brings.

A hands-off investor will just write a check. A strategic, hands-on partner can open your network, help you navigate pivots, and offer priceless support during tough times.

Advice:

Conduct due diligence on your investors.

Talk to other founders in their portfolio.

Ask how involved the investor is and what kind of support they provide. Do they advocate for their founders or do they micromanage?

Prioritize investors who offer industry expertise, valuable networks, and shared vision over those who simply have money to deploy.

Think of fundraising as finding partners, not just backers.

Myth #3: Raise as Much as You Can

Reality: More money isn’t always better. Investors expect you to deploy capital efficiently, not let it sit idle.

Raising a large round can seem like a win, but if you can’t spend it effectively or justify the capital allocation, it raises red flags. Extra capital often leads to bloat, waste, and loss of focus.

Advice:

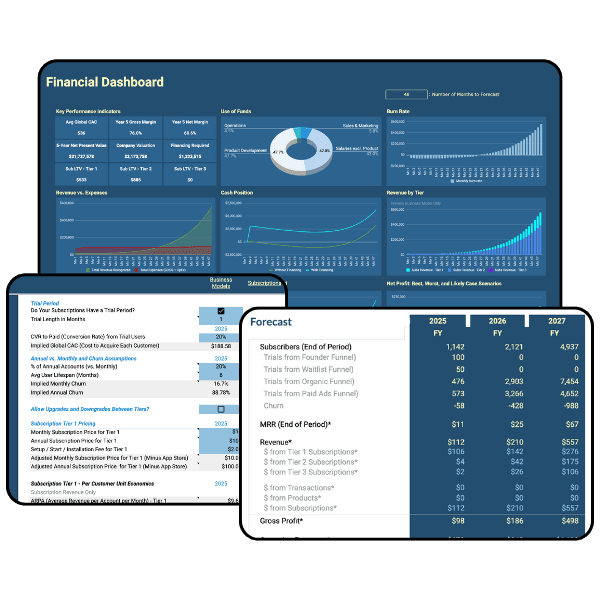

When building your financial model, start with a “blank check” thought exercise:

Imagine you have unlimited funds—what would your ideal strategy look like?

Then, apply some common sense. Do you really need 100 engineers right away? Can you even hire that fast?

Ask yourself: What is possible to spend and execute effectively in the next 18–24 months?

Efficient capital deployment is as important as raising capital itself. Investors fund execution, not excess.

Myth #4: Focus on Raising One Mega Round of Funding

Reality: It’s better to raise less money, more often, than to overextend on a massive round too early.

Raising a huge round can feel like validation, but it often comes with unrealistic expectations. Many VCs target 30x–40x returns, and a high valuation only raises the bar for your eventual exit.

A more measured fundraising approach—raising smaller rounds as you hit milestones—keeps you agile, focused, and in control of your company’s direction.

Advice:

Resist the temptation to raise a “mega round” before you’ve validated your model. Instead:

Set milestones for product, revenue, or traction.

Raise what you need to reach those milestones.

Revisit valuation as your business proves itself.

Smaller, milestone-based rounds demonstrate capital efficiency and disciplined growth, which investors love to see.

Myth #5: You Need to Raise Money to Build an MVP

Reality: Investors expect some level of traction before writing checks.

The days of raising a seed round on an idea alone are mostly gone. With today’s no-code and low-code tools, anyone can build a minimum viable product (MVP) and validate early customer demand without heavy upfront costs.

Investors want proof that you can execute and that users want what you’re building. This could mean early sign-ups, pilot users, or engagement metrics.

Advice:

Before approaching investors, use inexpensive tools to build a working prototype and gather real user feedback. Show that you’ve validated your assumptions and have momentum.

Remember: don’t raise money to build your MVP. Build your MVP to raise money.

Myth #6: Demonstrate Growth Above All Else

Reality: The “growth first” mindset of the early 2000s has given way to a profitability-focused approach.

For years, startups were encouraged to prioritize hypergrowth—scale fast, dominate the market, worry about profits later. Today’s investors want to see a clear path to profitability from the start.

Fast growth is great, but sustainable growth is better. Investors look for signs of healthy margins, efficient unit economics, and strategic spending.

Advice:

Use your financial model to demonstrate both growth potential and operational discipline.

Highlight when and how you’ll reach breakeven.

Show how growth translates to improved margins.

Build credibility by illustrating your path to profitability, not just expansion.

Investors want to back founders who understand that growth without profitability is no longer a badge of honor—it’s a liability.

Final Thoughts

Fundraising isn’t about selling a dream—it’s about proving you can execute it.

Investors don’t just back startups; they back founders who think strategically, act rationally, and deploy capital effectively. By avoiding these common myths, you’ll build not only a stronger fundraising process but a healthier, more sustainable company.